Every load that moves depends on trust. You make daily choices about which carriers you hand freight to, often with limited information and under tight deadlines. One oversight can turn into stolen freight, a denied claim, or a customer you cannot win back.

Carrier vetting sits at the center of freight fraud prevention and managing compliance risk. The 2025 Transportation Management Benchmark Survey gathered insights from over 600 global industry leaders, and carrier vetting emerged as a high-priority topic this year, cited by 25% of respondents. The trend extends across the entire carrier lifecycle, as carrier monitoring ranked as a top-three priority for Transportation Management System (TMS) capabilities. These numbers reflect an industry on alert. End-to-end freight security is now paramount, and it all begins with onboarding the right partners. Carrier vetting has become business critical.

Here are five carrier vetting mistakes to avoid if you want secure freight, faster onboarding, and fewer surprises.

1) Single-source checks that create blind spots

Relying only on Federal Motor Carrier Safety Administration (FMCSA) records leaves gaps. Paperwork can look fine while identity, authority, or safety records in federal and industry databases tell a different story. Fraudsters exploit that gap because they know many teams stop at the first clean check.

How to avoid it: Build a carrier vetting process that pulls from multiple databases in real time to authenticate identity, authority, and insurance. Go beyond basic FMCSA claims with tools like Descartes MacroPoint™ that gives you visibility into carriers’ actual service history and operating territories. Source trustworthy data to reduce compliance risk and strengthen freight fraud prevention.

2) Assuming insurance coverage means protection

Insurance is often treated as a box to check. But without deeper verification, coverage limits may not match the freight value, policies may be close to expiration, or the insurer may not be financially stable. When that happens, claims get denied, liability shifts back to you, and customers lose confidence in your ability to safeguard their loads.

How to avoid it: Automating insurance verification can help you avoid manual mistakes and keep unqualified carriers out of your network. Modern tools source certificates directly from insurance providers to ensure authenticity, validate coverage levels against freight value, and flag expirations before they lapse. They can also uncover independent ratings such as AM Best to ensure coverage is backed by a reliable underwriter.

3) Letting paperwork slide during onboarding

Vetting lives in the paperwork. When carrier packets are incomplete, inconsistent, or left unverified, they create gaps that fraudsters exploit. A forged Certificate of Insurance (COI) or mismatched tax record might pass at first glance, but it will not hold up for a claim or in an audit.

How to avoid it: Standardize what you collect, validate documents against trusted sources, and use structured digital intake instead of email attachments. Add automation for expirations so records stay current without having your staff manually chase them down.

4) Applying the same vetting standard everywhere

Fraud risk varies by region and freight type. The 2025 Transportation Management Benchmark Survey showed North American respondents ranked carrier vetting and monitoring higher than Europeans, and customer priorities vary widely. Teams that overlook these differences when managing high-value goods or hot-shot loads leave their freight more vulnerable than they realize.

How to avoid it: Calibrate vetting depth by region and freight type. Certain states across the US may require stricter identity checks and some customers demand higher insurance thresholds. Align your screening process with actual risk and avoid preventable losses.

5) Not Balancing Automation and Oversight

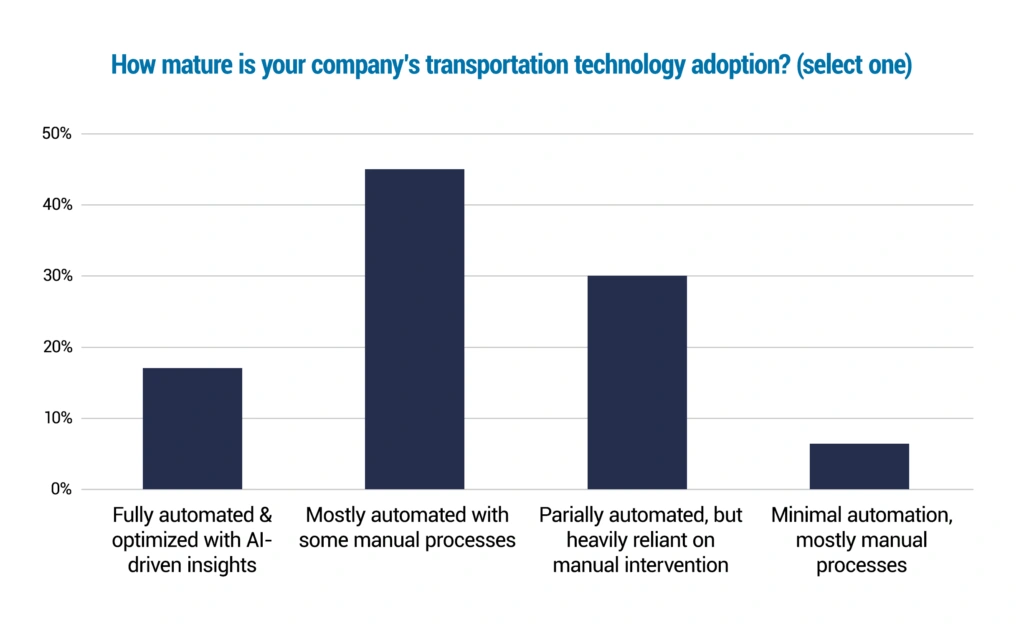

Fraud hides in reused phone numbers and copy-pasted COIs. Manual review rarely connects those dots at scale, which is where automation shines, linking patterns across applications, time, and data sources. The Benchmark Survey found only 17% of companies are fully automated, so there’s clear room to cut risk with targeted automation. Though, there’s still a chance for outliers. Don’t ignore the human intuition that can provide a final polish.

How to avoid it: Lead with automation. Catch duplicates, suspicious new motor carrier (MC) and vehicle identification number (VIN) mismatches, along with conflicts between geolocation and paperwork in real time. When you run into a red flag, an efficient human check ties off loose ends. Call dispatch or the driver, confirm VINs, and reconcile location against load documents. Automation covers the breadth. Focused human oversight solves edge cases.

Close the gaps before fraud finds you

Carrier vetting is becoming a test of discipline. Every corner cut during onboarding feels small in the moment, but later it could impact who gets hit with fraud losses, failed claims, or damaged customer trust. The teams that last are the ones who treat vetting as a craft, refining it with the same focus they bring to moving freight itself.

Read the 2025 Transportation Management Benchmark Survey to see how more organizations are taking that step and assess where your own practices stand. If you want to put this into motion, solutions like Descartes MyCarrierPortal can help standardize carrier vetting, strengthen freight fraud prevention, and reduce compliance risk from the start.

Research where you stand, discover what’s possible, and take the action needed to protect your freight.

Learn More

Looking for secure freight, faster onboarding, and fewer surprises?